The Benefits of Expense Tracking Software

Expense tracking software is a valuable tool for individuals and businesses alike. By using this software, you can easily monitor and manage your expenses, leading to better financial control and decision-making.

Efficiency and Accuracy

One of the key benefits of expense tracking software is its ability to streamline the process of recording and categorising expenses. With automated features, such as receipt scanning and data entry, you can save time and reduce the risk of errors in your financial records.

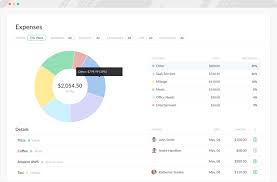

Real-Time Insights

Expense tracking software provides real-time insights into your spending patterns. By generating reports and visualisations, you can quickly identify areas where you are overspending or opportunities for cost-saving.

Budget Management

With expense tracking software, you can set budget limits for different expense categories. The software will alert you when you are approaching or exceeding your budget, helping you stay on track with your financial goals.

Compliance and Audit Trail

For businesses, expense tracking software helps ensure compliance with financial regulations. It also creates an audit trail that can be useful during tax season or internal audits.

Integration with Other Tools

Many expense tracking software solutions integrate with accounting software, payment platforms, and bank accounts. This seamless integration simplifies financial management tasks and provides a comprehensive view of your finances.

Conclusion

Expense tracking software offers numerous benefits for individuals and businesses looking to improve their financial management practices. By leveraging the efficiency, accuracy, real-time insights, budget management features, compliance support, and integration capabilities of this software, you can take control of your expenses and make informed financial decisions.

Seven Essential Tips for Selecting and Utilising Expense Tracking Software Efficiently

- Choose a user-friendly expense tracking software to make it easier for everyone in your team to use.

- Ensure the software is compatible with your existing accounting systems for seamless integration.

- Set up automated features such as receipt scanning to save time and reduce manual data entry errors.

- Regularly reconcile your expenses in the software with bank statements to ensure accuracy.

- Utilize reporting tools provided by the software to gain insights into spending patterns and make informed decisions.

- Implement approval workflows within the software to streamline the expense approval process and maintain control over expenses.

- Train employees on how to use the expense tracking software effectively to maximise its benefits.

Choose a user-friendly expense tracking software to make it easier for everyone in your team to use.

Selecting a user-friendly expense tracking software is crucial for ensuring seamless adoption and usage within your team. By choosing software that is intuitive and easy to navigate, you can empower all team members to efficiently track their expenses without facing unnecessary hurdles. A user-friendly interface not only promotes better engagement but also enhances overall productivity by simplifying the expense tracking process for everyone involved.

Ensure the software is compatible with your existing accounting systems for seamless integration.

When considering expense tracking software, it is crucial to ensure that the chosen platform is compatible with your existing accounting systems. Seamless integration between the expense tracking software and your accounting systems can streamline financial processes, eliminate manual data entry errors, and provide a comprehensive overview of your finances. By opting for software that seamlessly integrates with your current systems, you can enhance efficiency, accuracy, and overall financial management practices within your organisation.

Set up automated features such as receipt scanning to save time and reduce manual data entry errors.

Setting up automated features like receipt scanning in your expense tracking software can significantly enhance your financial management process. By automating the task of capturing and categorising expenses, you not only save valuable time but also minimise the risk of manual data entry errors. This streamlined approach allows you to maintain accurate and up-to-date financial records effortlessly, giving you more control over your expenses and enabling better decision-making based on reliable data.

Regularly reconcile your expenses in the software with bank statements to ensure accuracy.

It is essential to regularly reconcile your expenses in the tracking software with your bank statements to ensure accuracy and financial integrity. By comparing the transactions recorded in the software with those reflected in your bank statements, you can identify any discrepancies or errors promptly. This practice not only helps maintain accurate financial records but also provides a clear overview of your spending habits and ensures that all expenses are accounted for correctly.

Utilize reporting tools provided by the software to gain insights into spending patterns and make informed decisions.

By utilising the reporting tools offered by expense tracking software, individuals and businesses can gain valuable insights into their spending patterns. These tools enable users to generate detailed reports and visualisations that highlight where their money is being allocated. By analysing this data, users can make informed decisions about their finances, identify areas for cost-saving, and adjust their budget accordingly. This proactive approach to financial management can lead to better control over expenses and ultimately contribute to improved financial health.

Implement approval workflows within the software to streamline the expense approval process and maintain control over expenses.

To enhance expense management efficiency, implementing approval workflows within the expense tracking software is crucial. By setting up structured approval processes, businesses can streamline the expense approval process, ensuring that all expenses are reviewed and approved in a timely manner. This not only improves accountability and compliance but also helps maintain control over expenses by enforcing consistent approval protocols. With automated workflows in place, organisations can reduce bottlenecks, enhance transparency, and make informed decisions regarding expenditure, ultimately contributing to better financial control and decision-making.

Train employees on how to use the expense tracking software effectively to maximise its benefits.

To maximise the benefits of expense tracking software, it is essential to train employees on how to use the software effectively. By providing comprehensive training sessions, employees can learn how to navigate the software’s features, input expenses accurately, and generate meaningful reports. This training ensures that all team members are proficient in using the software, leading to improved efficiency, accuracy, and compliance with expense tracking practices. Investing in employee training for expense tracking software can result in enhanced financial control and better decision-making within the organisation.