The Benefits of Xero Accounting Software for Your Business

In today’s fast-paced business world, efficient financial management is crucial for success. One tool that has revolutionised the way businesses handle their accounting needs is Xero accounting software.

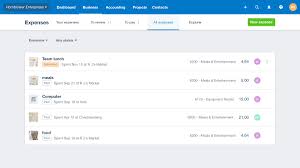

Xero is a cloud-based accounting software that offers a wide range of features to help businesses streamline their financial processes. From invoicing and payroll to bank reconciliation and expense tracking, Xero provides a comprehensive solution for managing your finances effectively.

One of the key benefits of Xero is its accessibility. Being cloud-based means you can access your financial data anytime, anywhere, as long as you have an internet connection. This flexibility allows business owners and accountants to stay on top of their finances even when they are on the go.

Another advantage of Xero is its user-friendly interface. The software is designed to be intuitive and easy to navigate, making it simple for users to perform tasks such as creating invoices, generating reports, and managing expenses without any hassle.

Xero also offers seamless integration with other business tools and apps, allowing you to connect your accounting software with your CRM system, e-commerce platform, or payment gateway. This integration helps streamline your business processes and ensures data consistency across different platforms.

Furthermore, Xero provides powerful reporting capabilities that give you valuable insights into your business performance. With detailed financial reports and real-time dashboards, you can make informed decisions based on accurate data and track your progress towards your financial goals.

In conclusion, Xero accounting software offers a host of benefits for businesses looking to improve their financial management processes. With its accessibility, user-friendly interface, integration capabilities, and powerful reporting features, Xero can help you take control of your finances and drive growth in your business.

Mastering Xero Accounting: 8 Essential Tips for Business Success

- Set up your chart of accounts accurately to reflect your business transactions.

- Regularly reconcile your bank accounts to ensure accuracy in your financial records.

- Utilize Xero’s invoicing features to streamline the billing process for your clients.

- Take advantage of Xero’s reporting tools to gain insights into your business performance.

- Integrate third-party apps with Xero for additional functionality and efficiency.

- Ensure proper categorisation of expenses for better financial analysis.

- Regularly review and update your financial data in Xero to stay on top of your finances.

- Attend training sessions or webinars offered by Xero to enhance your accounting skills.

Set up your chart of accounts accurately to reflect your business transactions.

Setting up your chart of accounts accurately is essential in Xero accounting to ensure that your business transactions are properly categorised and recorded. By structuring your chart of accounts to align with your specific business activities, you can gain better insights into your financial performance and make informed decisions. Accurate categorisation of income, expenses, assets, and liabilities allows for clearer financial reporting and analysis, helping you track the flow of money in and out of your business effectively. Therefore, taking the time to set up a well-organised chart of accounts in Xero can greatly benefit your business in maintaining financial clarity and compliance.

Regularly reconcile your bank accounts to ensure accuracy in your financial records.

Regularly reconciling your bank accounts is a crucial practice to maintain accuracy in your financial records when using Xero accounting software. By comparing the transactions in your bank statements with those recorded in Xero, you can identify discrepancies, detect errors, and ensure that all financial data is up to date and correct. This process not only helps prevent potential financial discrepancies but also provides you with a clear and accurate picture of your business’s financial health, enabling you to make informed decisions based on reliable information.

Utilize Xero’s invoicing features to streamline the billing process for your clients.

By utilising Xero’s invoicing features, businesses can streamline the billing process for their clients effectively. With Xero’s user-friendly interface and customisable invoicing templates, businesses can easily create professional-looking invoices, send them to clients electronically, and track payment status in real-time. This not only saves time and effort but also enhances the overall client experience by providing a seamless and efficient billing process.

Take advantage of Xero’s reporting tools to gain insights into your business performance.

By utilising Xero’s reporting tools, you can delve deep into your business performance and extract valuable insights that can guide strategic decision-making. With detailed financial reports and real-time dashboards at your disposal, you can track key metrics, identify trends, and assess the effectiveness of your financial strategies. By harnessing the power of Xero’s reporting capabilities, you can make informed decisions that drive growth and success for your business.

Integrate third-party apps with Xero for additional functionality and efficiency.

By integrating third-party apps with Xero accounting software, businesses can enhance their functionality and efficiency significantly. This feature allows users to connect Xero with various tools and applications, such as CRM systems, e-commerce platforms, and payment gateways, streamlining processes and ensuring seamless data flow between different systems. By leveraging these integrations, businesses can automate repetitive tasks, improve data accuracy, and gain valuable insights into their financial performance, ultimately boosting productivity and driving growth.

Ensure proper categorisation of expenses for better financial analysis.

Ensuring proper categorisation of expenses in Xero accounting is essential for conducting accurate financial analysis. By categorising expenses correctly, businesses can gain a clear understanding of where their money is being spent and identify areas for potential cost savings or investment. Properly categorised expenses also enable businesses to generate more meaningful financial reports, track key performance indicators, and make informed decisions based on reliable data. Inaccurate expense categorisation can lead to skewed financial insights and hinder the ability to effectively manage finances. Therefore, taking the time to categorise expenses accurately in Xero can significantly enhance a business’s financial analysis capabilities.

Regularly review and update your financial data in Xero to stay on top of your finances.

Regularly reviewing and updating your financial data in Xero is essential to staying on top of your finances. By consistently monitoring and maintaining accurate records, you can ensure that your financial information is up-to-date and reflective of your current business performance. This practice not only helps you make informed decisions but also allows you to identify any discrepancies or trends that may require attention. Keeping a close eye on your financial data in Xero enables you to have a clear understanding of your financial health and empowers you to take proactive steps towards achieving your business goals.

Attend training sessions or webinars offered by Xero to enhance your accounting skills.

Attending training sessions or webinars offered by Xero is a valuable tip to enhance your accounting skills. These sessions provide a great opportunity to deepen your understanding of the software’s features and functionalities, enabling you to leverage its full potential for your business. By participating in Xero training, you can stay updated on the latest tools and techniques, improve your efficiency in managing financial tasks, and ultimately boost your confidence in using the software effectively. Investing time in learning from experts through Xero training can significantly enhance your accounting skills and contribute to the success of your financial management efforts.